Economics of Social Expenditure (2024)

Topic outline

-

Professors

David Cantarero Prieto

Paloma Lanza León

Javier Isaac Lera Torres

Department of Economics

The subject Economics of Social expenditure deals with topics of great interest and current events related to the state of well-being and spending in various areas such as education, health, housing, pensions, dependency, performance or minimum vital income; as well as the fundamentals that govern spending in these areas and the methodologies for the correct evaluation and control of spending in the different programs.

Keywords

Public expenditure, public policies, merit goods, health, education, housing, monetary benefits, social exclusion, discrimination, poverty.

-

Course Information

-

Course title: Economics of Social Expenditure

-

Code: G2009

-

Department / Unit: Department of Economics

-

Degree / Master’s: Degree in Economics

-

Faculty: Faculty of Law and Economics

-

ECTS credits: 6

-

Language of instruction: English

-

Instructors: David Cantarero Prieto / Paloma Lanza León / Javier Isaac Lera Torres

Course structure

THEMATIC SECTION 1: INTRODUCTION TO THE STUDY OF THE ECONOMICS OF SOCIAL EXPENDITURE

1.1 THE ECONOMICS OF PUBLIC EXPENDITURE AND EVALUATION OF PUBLIC POLICIES

The Economics of Public Expenditure. Explanatory theories of the growth of public expenditure. Evolution and characteristics of public expenditure. Developments issues of various items of public expenditure and social. The evaluation of public policies.THEMATIC SECTION 2: ECONOMIC ANALYSIS OF THE EXPENDITURE ON MERIT GOODS

2.1 PUBLIC EXPENDITURE ON MERIT GOODS: HEALTH

The Welfare State. Distribution of public expenditure in health care: theory and practice

2.2 PUBLIC EXPENDITURE ON MERIT GOODS: EDUCATION

The Welfare State. Distribution of public expenditure in education: theory and practice

2.3 PUBLIC EXPENDITURE ON MERIT GOODS: HOUSING

The Welfare State. Distribution of public spending in housing: theory and practiceTHEMATIC SECTION 3: ECONOMIC ANALYSIS OF THE EXPENDITURE ON MONETARY BENEFITS

3.1 PUBLIC EXPENDITURE ON MONETARY BENEFITS: PENSIONS

The Welfare State. Distribution of public spending in pensions: theory and practice

3.2 PUBLIC EXPENDITURE ON MONETARY BENEFITS: BENEFITS FOR UNEMPLOYMENT AND FOR THE FIGHT AGAINST POVERTY, SOCIAL EXCLUSION AND DISCRIMNATION

The Welfare State. Distribution of public expenditure in unemployment benefits versus in programs for the fight against poverty, social exclusion and

discrimination (minimum vital income): theory and practice.

3.3 PUBLIC EXPENDITURE ON MONETARY BENEFITS: DEPENDENCE

The Welfare State. Distribution of public expenditure in dependency: theory and practiceTHEMATIC BLOCK 4: ECONOMIC EVALUATION OF PUBLIC AND SOCIAL EXPENDITURE

4.1 EVALUATION COST-BENEFIT/COST-EFFECTIVENESS AND CONTROL LEGAL OF PUBLIC AND SOCIAL EXPENDITURE

Public expenditure and the efficiency and economy of welfare. Evaluation, Discount Rates and Rules of decision. Evaluation of efficiency and equity and institutionalization of public sector control and social expenditures. -

-

Required reading list

- Cantarero, D., Blazquez, C., Pascual, M., Lanza, P, Lera, J. and Cotero, G. (2023): Exercises of Economics of Social expenditure. Santander: TGD.

Suggested additional reading

- Le Grand, J. (2007): The Other Invisible hand: delivering public services through choice and competition. Princeton: Princeton University Press.

- Rainey, H. (2009): Understanding and Managing Public Organizations. San Francisco, CA: Jossey-Bass.

- OECD Health Statistics: http://www.oecd-ilibrary.org/social-issues-migration-health/data/oecd-health-statistics_health-data-en

-

THEMATIC SECTION 1: INTRODUCTION TO THE STUDY OF THE ECONOMICS OF SOCIAL EXPENDITURE

- MC-F-001. 1.1 THE ECONOMICS OF PUBLIC EXPENDITURE AND EVALUATION OF PUBLIC POLICIES

THEMATIC SECTION 2: ECONOMIC ANALYSIS OF THE EXPENDITURE ON MERIT GOODS

- MC-F-002. 2.1 PUBLIC EXPENDITURE ON MERIT GOODS: HEALTH

- MC-F-003. 2.2 PUBLIC EXPENDITURE ON MERIT GOODS: EDUCATION

- MC-F-004. 2.3 PUBLIC EXPENDITURE ON MERIT GOODS: HOUSING

THEMATIC SECTION 3: ECONOMIC ANALYSIS OF THE EXPENDITURE ON MONETARY BENEFITS

- MC-F-005. 3.1 PUBLIC EXPENDITURE ON MONETARY BENEFITS: PENSIONS

- MC-F-006. 3.2 PUBLIC EXPENDITURE ON MONETARY BENEFITS: BENEFITS FOR UNEMPLOYMENT AND FOR THE FIGHT AGAINST POVERTY, SOCIAL EXCLUSION AND DISCRIMNATION

- MC-F-007. 3.3 PUBLIC EXPENDITURE ON MONETARY BENEFITS: DEPENDENCE

THEMATIC BLOCK 4: ECONOMIC EVALUATION OF PUBLIC AND SOCIAL EXPENDITURE- MC-F-008. 4.1 EVALUATION COST-BENEFIT/COST-EFFECTIVENESS AND CONTROL LEGAL OF PUBLIC AND SOCIAL EXPENDITURE

-

-

EP-F-001. Exercises Topic 1.1 Introduction

-

EP-F-002. Exercises Topic 2.1 Health

-

EP-F-003. Exercises Topic 2.2 Education

-

EP-F-004. Exercises Topic 2.3 Housing

-

EP-F-005. Exercises Topic 3.1 Pensions

-

EP-F-006. Exercises Topic 3.2 Unemploymen, fight against poverty, social exclusion and discrimination

-

EP-F-007. Exercises Topic 3.3 Dependence

-

EP-F-008. Exercises Topic 4.1 Evaluation cost-benefit/cost-effectiveness and control legal of public and social expenditure

-

EP-F-001. Exercises Topic 1.1 Introduction

-

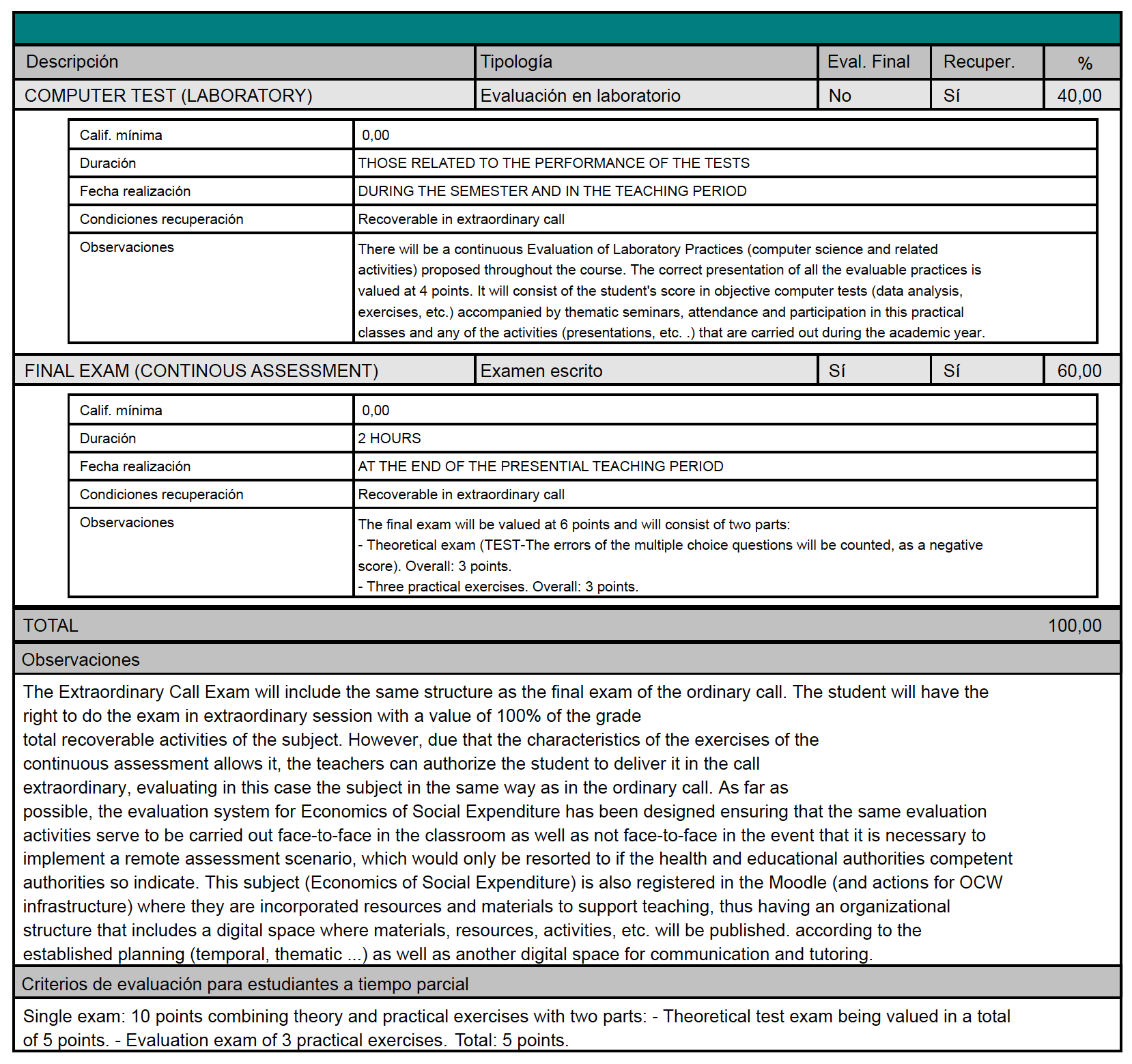

Assessment criteria

-

-

David Cantarero Prieto

Department of Economics

UNIVERSIDAD DE CANTABRIA

Additional information

Paloma Lanza León

Department of Economics

UNIVERSIDAD DE CANTABRIA

Additional information

Javier Isaac Lera Torres

Department of Economics

UNIVERSIDAD DE CANTABRIA

Additional information