Public Ecomics (2024)

Topic outline

-

Professors

David Cantarero Prieto

Carla Blázquez Fernández

Paloma Lanza León

Javier Isaac Lera Torres

Department of Economics

In Public Economics, several topics of great relevance are studied, starting with the introduction to the public sector, as well as reasons for intervention. In addition, budget and public revenues are analyzed, with special focus on regulatory criteria and economic effects. Finally, beyond the national topics, we consider fiscal policy and international public economics.

Keywords

Public Sector, Budget, Expenditure, Revenues, Welfare economics, International public economics

-

Forum

-

-

Course Information

-

Course title: Public Economics

-

Code: G2006

-

Department / Unit: Department of Economics

-

Degree / Master’s: Degree in Economics

-

Faculty: Faculty of Law and Economics

-

ECTS credits: 6

-

Language of instruction: English

-

Instructors: David Cantarero Prieto / Carla Blázquez Fernández/ Paloma Lanza León / Javier Isaac Lera Torres

Course structure

THEMATIC SECTION 1: THEORETICAL FOUNDATIONS OF THE PUBIC SECTOR

- 1.1 THE ECONOMICS OF PUBLIC SECTOR AND THE OBJECT OF STUDY

THEMATIC SECTION 2: ANALYSIS OF THE PUBLIC SECTOR INTERVENTION

- 2.1 THE NORMATIVE PUBLIC FINANCE

- 2.2 THEORY OF PUBLIC GOODS AND EXTERNALITIES

- 2.3 PUBLIC CHOICE THEORY

THEMATIC SECTION 3: PUBLIC REVENUE: NORMATIVE CRITERIA AND ECONOMIC EFFECTS

- 3.1 INCIDENCE OF TAXATION ON ECONOMIC EFFICIENCY AND EQUITY

- 3.2 OTHER PUBLIC INCOME

-

-

- Atkinson, A.B., Stiglitz, J.E. (2015): Lectures on Public Economics, Princeton University Press.

- Auerbach, A.J., Chetty, R., Feldstein, M., Saez, M. (eds.) (2013): Handbook of Public Economics. Elsevier.

- Forte, F. et al (2015). A Handbook of Alternative Theories of Public Economics. Edward Elgar

- Gruber, J. (2019). Public finance and public policy. Worth Publishers.

- Hindriks, J., Myles, G.D. (2006): Intermediate Public Economics. MIT Press, Cambridge.

- Stiglitz, J.E., Rosengard, J.K. (2015): Economics of the Public Sector, Fourth Edition, W.W. Norton & Company

- Tanzi, V. (2020): Advanced Introduction to Public Finance. Elgar Advanced.

- Tresch, R.W. (2008): Public Sector Economics, Palgrave Economics.

-

THEMATIC SECTION 1: THEORETICAL FOUNDATIONS OF THE PUBIC SECTOR

- MC-F-001. 1.1 THE ECONOMICS OF PUBLIC SECTOR AND THE OBJECT OF STUDY

THEMATIC SECTION 2: ANALYSIS OF THE PUBLIC SECTOR INTERVENTION

THEMATIC SECTION 3: PUBLIC REVENUE: NORMATIVE CRITERIA AND ECONOMIC EFFECTS

-

- EX-F-001. TOPIC 1.1. THE PUBLIC SECTOR ECONOMY AND ITS OBJECT OF STUDY

- EX-F-002. TOPIC 2.1. THE NORMATIVE PUBLIC FINANCE

- EX-F-003. TOPIC 2.2. THEORY OF PUBLIC GOODS AND EXTERNALITIES

- EX-F-004. TOPIC 2.3. PUBLIC CHOICE THEORY

- EX-F-005. TOPIC 3.1. DISTRIBUTIONAL INCIDENCE OF TAXATION

- EX-F-006. TOPIC 3.2: OTHER PUBLIC INCOME

-

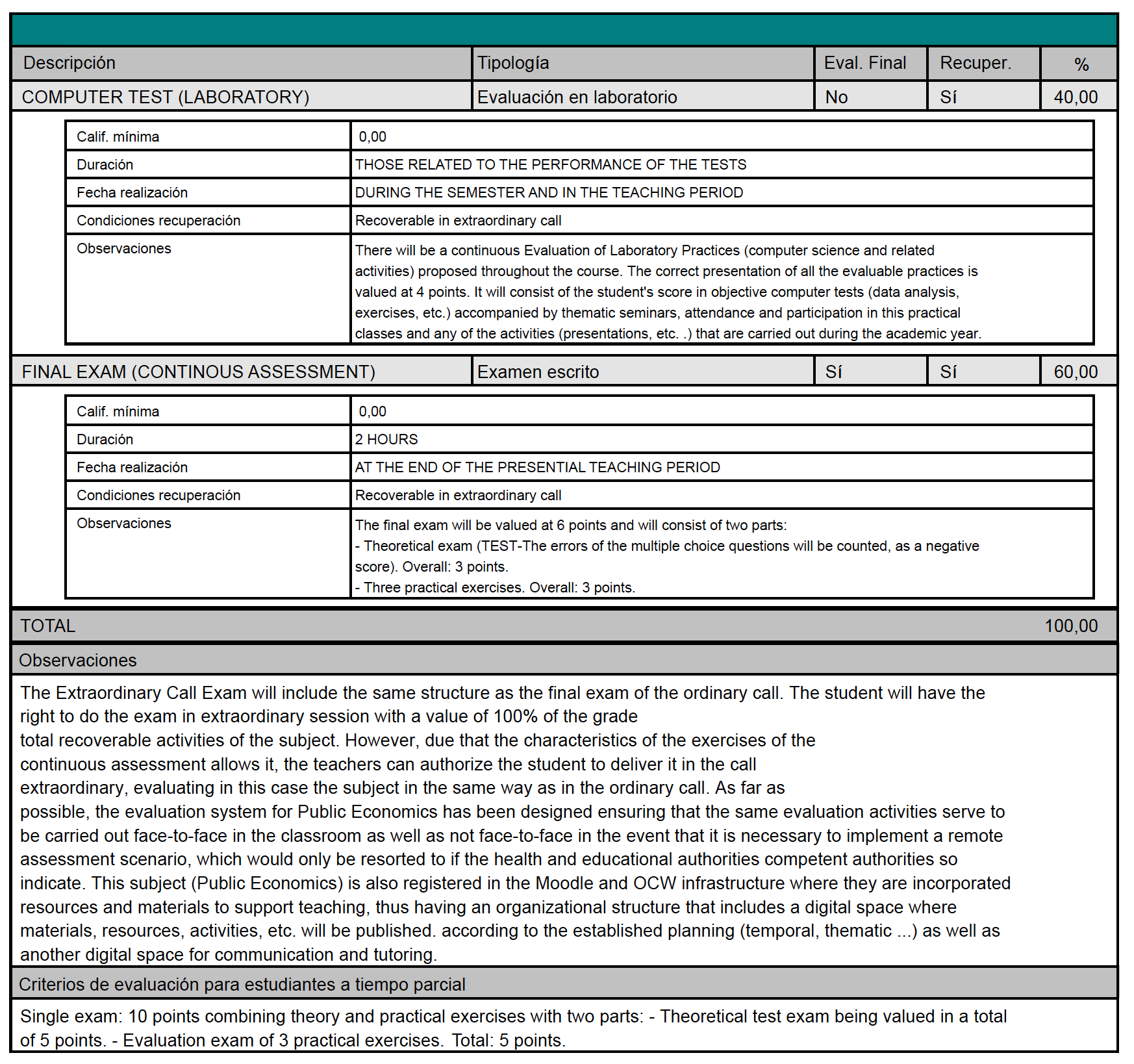

Assessment criteria

-

-

David Cantarero Prieto

Department of Economics

UNIVERSIDAD DE CANTABRIA

Additional information

Carla Blázquez Fernández

Department of Economics

UNIVERSIDAD DE CANTABRIA

Additional information

Paloma Lanza León

Department of Economics

UNIVERSIDAD DE CANTABRIA

Additional information

Javier Isaac Lera Torres

Department of Economics

UNIVERSIDAD DE CANTABRIA

Additional information